Stocks fall as mutual assets drain

The shared asset area dropped by more than 4% yesterday because of value changes subsequent to announcing higher profits.

Aside from this area, the bank, non-bank monetary organization (NBFI), pharma and material areas likewise fell, which eventually adversely affected the market list.

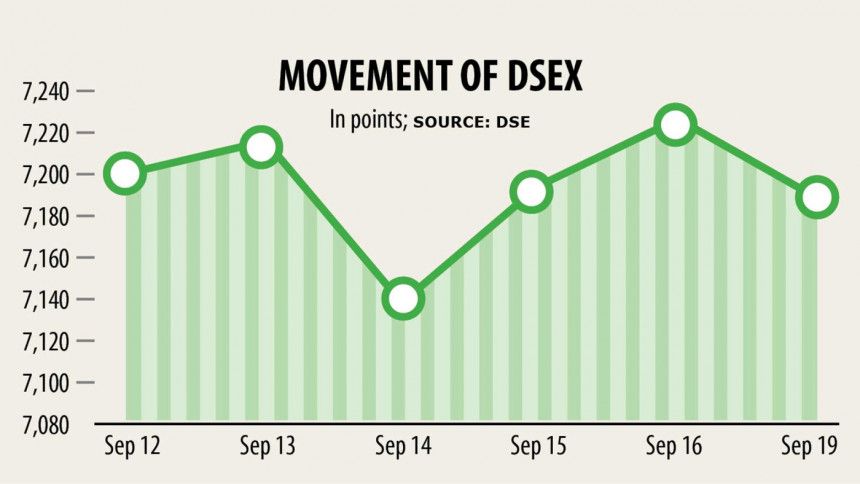

The DSEX, the benchmark record of the Dhaka Stock Exchange (DSE), dropped 36 focuses, or 0.50 percent, to 7,191 following a two-day rise.

“As the trading of many mutual funds resumed after price adjustments following dividend declarations on the day, the sector fell,” a stock broker said.

Additionally, the assets’ fall has an overflow impact on financial backers’ mindset so among the 37 recorded shared assets, one rose and nine continued as before while all others dropped, DSE information shows.

Common supports pool cash from financial backers to channel it into protections like stocks, bonds, and different resources. Contingent upon the benefits procured, financial backers are delivered their offer as profits.

The shared asset area reported better profits this year as they made higher benefits from the securities exchange, he said. In the mean time, financial backers sold their offers in enormous capital-based organizations also since these stocks acquired around 10 to 12 percent over the most recent couple of weeks, the stock dealer added.

The capital market started the week with a difficulty in the midst of flimsy financial backer certainty, said International Leasing Securities in its market survey.

A day-long fight among hopeful and negative financial backers was noticed however failures started to lead the pack over gainers by the meeting’s end.

The financial backers’ consideration was fundamentally focused on monetary foundations (27.6 percent), material (15.3 percent), and designing (10.1 percent), it added.

Turnover, a significant marker of the market, diminished around 6% to Tk 2,033 crore while it was Tk 2,171 crore a meeting prior.

The enormous settled up capital-based organizations rose by around 10 to 12 percent on normal over the most recent couple of days so individuals are taking benefits, as per market experts.

Bangladesh Autocars beat the gainers’ rundown, rising 9.94 percent, trailed by Aziz Pipes, Aamra Technologies, Unique Hotels, and Rupali Insurance.

Famous Life First Mutual Fund shed the most, dropping 10%, trailed by AB Bank First Mutual Fund, PHP First Mutual Fund, Trust Bank First Mutual Fund, and First Janata Bank Mutual Fund.

At the DSE, 106 stocks rose, 244 declined and 26 stayed unaltered.

Supplies of Beximco Limited exchanged the most, worth Tk 132 crore, trailed by LankaBangla Finance, Beximco Pharmaceuticals, SAIF Powertec and IPDC.

The Chattogram Stock Exchange (CSE) additionally fell yesterday as the CASPI, the overall file of the port city bourse, edged down 158 focuses, or 0.74 percent, to 20,982.

Among 316 exchanged stocks, 88 progressed, 213 fell and 15 stayed unaltered.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Funds Pulse journalist was involved in the writing and production of this article.